Helping small business owners work smarter,

not harder—so you can focus on growth

Get paid instantly, every day

One simple account that handles payments, funding, and growth—without the nonsense of traditional banks.

-

Instant Settlements, Every Day

-

Built-in Growth Tools Included

-

No Surprises, No Hidden Fees

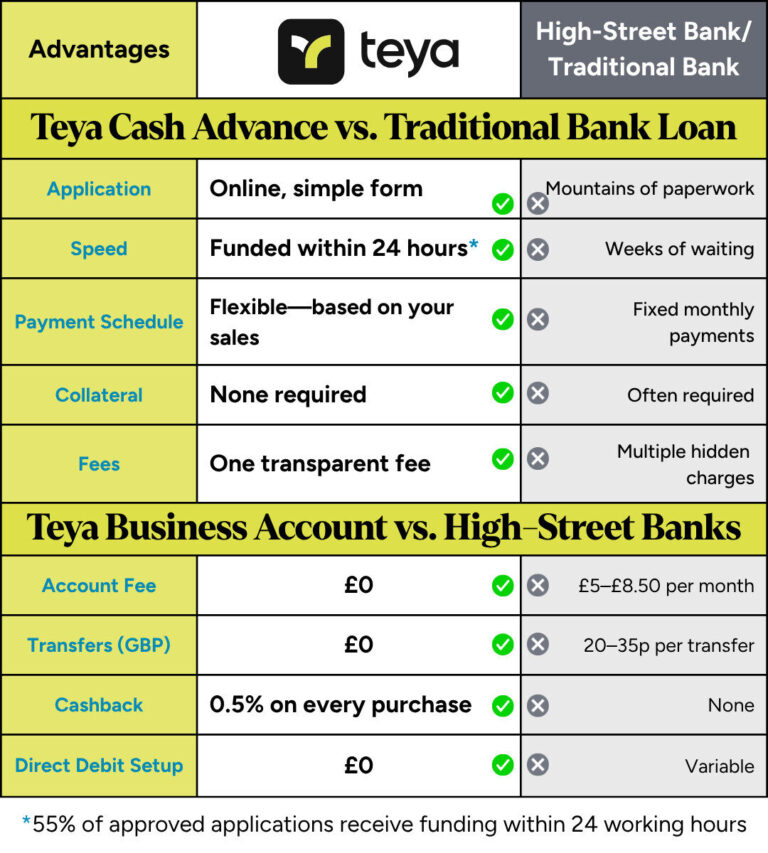

Traditional banks are slowing you down

- High-street banks bury fees in the fine print. They add up fast, and nobody explains where your money's actually going.

- Traditional bank loans are a nightmare—mountains of paperwork, weeks of waiting, and they want collateral you probably don't have.

- You're stressed about late fees or rigid monthly payments that don't match how your business actually makes money.

We get it.

Running a small business is relentless. We've built Teya as the financial partner that actually lightens the load—not another layer of admin.

Teya gives you everything you need in one place: payments, business banking, and growth funding. Plus, you’ve got real humans on the phone. 24/7 UK-based support, available round the clock.

Why Choose Us

You Keep Your Cash Moving

Your sales settle instantly into your Teya account—every single day, including weekends and bank holidays. No more waiting for days to access your own money.

Funding That Fits Your Business

Our Cash Advance works how you actually work. You pay back a percentage of your card sales, so when business is quiet, your payments are smaller. When you're busy, you pay a bit more. That's it.

Get Rewarded for Spending

Earn 0.5% unlimited cashback on every purchase you make with your Teya card. Sounds small, but it adds up.

Client Testimonials

Simple Three-Step Process

Request your free Business Account

Submit us your details including KYC Documents (Driving Licence/Passport/Recent Bills/Prove of Address etc)

Your machine (business card) arrives quickly

Teya verifies everything within 1–6 business days

Start taking payments immediately

With money hitting your account instantly

Your Unique Advantages

The Details

The Centrepiece

Pro Card Machine

• Lightning-fast transaction processing

• Simple checkout with built-in calculator and bill splitting

• Customers can add tips instantly

• Accept payments by email or SMS via Pay by Link

• 5.99-inch HD display (1440 × 720, IPS)

• 12-hour battery life, fully charged

• Built-in printer

• Free delivery and machine swap, no extra cost

• Lifetime warranty (includes theft and water damage)

FREE Business Account

Designed with small businesses in mind.

•Access your Teya Business Account in the app for a simple, transparent experience.

•It's simple, free to open and it rewards you with unlimited cashback on any purchase.

•Move money quickly, deposit cash, spend securely with your free visa cards, and much more.

Instant Settlements

•Money in your account instantly, 24/7!

•Free Business Account

Free Platinum Debit Card

•0.5% cashback, earn rewards on every purchase.

•Unlimited monthly cashback: powered by your Teya debit card.

•Create up to 10 free virtual cards instantly in the app.

Accepting All Major Cards

Built-in Apple Pay, Google Wallet, autofill, and 3DS for secure checkout

Cash Advance Up To £500,000

Flexible, fast and transparent funding - payable directly from your Teya card machine sales.

PCI DSS Compliance for You

Automatically Teya handles PCI Compliance for you

Teya Tap

•Take payments on your phone

•Turn your phone into a card machine for contactless payments.

50+ E-POS Integrations

Connect your existing business management software with Teya's simple integration tools.

Shopify and WooCommerce Integrations

Selling through Shopify or WooCommerce? Connect your store to Teya in minutes.

Real-Time Insights & Reports

Stay on top of your sales by tracking live updates in the Teya App and the portal.

Payment Links

No webstore? No problem. Send secure payment requests directly to your customers via email, SMS, Chat or printed QR code.

Create and send a link in seconds from your Teya app or card machine, and track everything from one place.

Digital Wallets

Tap through Apple Pay and Google Wallet for a fast and secure checkout

We're Here For You 24/7

Speak to a real person whenever you need support - fast, friendly and Uk-based. Available via WhatsApp Support, Email or Phone.

Answers to Your Most Common Questions

Q: What exactly does Teya offer me as a business owner? One platform for payments, banking and growth. Card machines, a business account with cashback, cash advances when you need them, and fast next-day settlements 7 days a week, all in one. Plus, unrivaled UK-based support that's ready for you 24/7.

Q: What makes Teya different from other payment providers? We do more. Others give you a card machine. We give you a business toolkit: payments, banking, support and funding, designed to grow with you.

Q: What's the price? We don't do one-size-fits-all pricing. Tell us about your business, and we'll create a plan that actually works for you. Get in touch with MySvc anytime—we're here to help.

Q: Are there any hidden fees? No hidden charges. No lock-ins. No small print. Just clear, honest pricing.

Q: How do I get started? It's fast and frictionless. You apply online and your card machine ships fast. You can begin taking payments immediately once your card machine arrives. In parallel, we verify you within 1-3 business days so that you can begin receiving your funds.

Q: Which plan is right for my business? All plans include a free Business Account and access to Tap on Phone at no additional cost. Choose the plan that matches your growth. Start is for getting up and running, with no monthly fees. Boost cuts your transaction rates and saves you money on hardware. Thrive gives you the lowest fees if you're processing more. Custom is tailored for high-volume merchants.

Q: Can I change plans later? Yes. As your business grows, you can change plans whenever - no penalty, no hassle.

Q: Which payment methods can I accept? All major payment methods, including Visa, Mastercard, AMEX, Apple Pay, Google Pay, Samsung Pay, Maestro, Visa Electron, and V Pay.

Q: How quickly do I get paid after a sale? / How do I receive my payments? You get instant payments directly to your Teya Business Account the moment a transaction completes. Your cash flow moves at the speed of your business—7 days a week, including weekends and bank holidays. No waiting, no delays.

Q: Can I view and monitor my transactions? Yes, you can check daily sales numbers or detailed breakdowns directly on your card machine. And you can track settlements and monitor transactions on your phone or computer using the Teya app.

Q: How long does it take to set up my card machine? Once your card machine has been delivered to you, it takes just five minutes to set your card machine up, so you can start taking payments straight away.

Q: Is the card machine secure? Teya operates under the highest security standards, working together with leading industry partners and regulators. We encrypt all card and PIN data end-to-end to make sure you and your customers are protected at all times.

Q: Does it integrate with existing systems? / Can I use Teya with my current setup? Yes, our card machine integrates with over 50 ePOS systems to help simplify your business operations. Our devices work out of the box and integrate with 50+ major POS systems. No disruption, just better service.

Q: What card machines do I get with each plan? You choose the card machine that fits your business. All plans let you pick whichever hardware works best for how you sell. With Boost, your first device is half price. With Thrive, your first device is free and your second is half price.

Q: Can I take card payments remotely? Yes, you can use our Pay-by-link feature on the terminal to seamlessly send links over email or SMS to your customers, so they can pay you wherever they are.

Q: Do I need a separate bank account to use Teya? No. Teya Business Account is included for free with all plans and it's built to help you earn cashback, settle faster and manage cash flow with ease. Want to use a different bank account? Just let us know. We'll settle your funds there at no extra cost.

Q: What's a business account? A business account is an account specifically thought for managing a company's finances. It is where you get your card machine sales settled. You can use your business account as you'd use a normal bank account to pay suppliers, transfer money and monitor your cash flow.

Q: Is Teya Business Account free? Yes! Teya Business Account is free to open and has no account fees. You can enjoy free domestic money transfers and direct debit setup, order your Teya card for free and start spending to earn cashback.

Q: Who can apply for Teya Business Account? All Teya customers can open a Teya Business Account for free and enjoy its benefits, like earning unlimited cashback. If you're not a customer yet, contact Teya to start your journey.

Q: Do I need a business account? A business account is essential for limited companies and a preferred requirement for sole traders as well. It helps separate personal and business finances, making management easier, and it simplifies tax filing, bookkeeping, and even enhances the professional image of a business. Moreover, a business bank account can help build your business credit score, which is crucial for accessing loans and growth opportunities.

Q: What's a merchant Cash Advance? A Merchant Cash Advance (MCAs) is a type of revenue-based financing that provides a simple and flexible way to get fast funding, based on your future sales.

Q: How much funding can I get with Teya Cash Advance? The amount of Cash Advance you can receive depends on several factors, including how long your business has been operating and your monthly Teya card turnover.

Q: Who can apply for merchant Cash Advance? Teya Cash Advance is available to all Teya customers. If you've been using Teya card machine consistently for at least 4 months, you might be already pre-approved for a Cash Advance.

Q: How much will Cash Advance cost me? Cash Advance total cost is made of your funding plus a one-time fixed fee that you choose upfront. There are no interest rates nor other fees.

Q: Why choose Teya over traditional loans? Unlike traditional loans that require lengthy approval processes and fixed monthly repayments, Teya Cash Advance is fast, flexible, and tailored to your business's sales. It's an ideal solution for small businesses seeking a hassle-free way to secure funds quickly.

Q: What can I use Teya Cash Advance for? Teya Cash Advance is designed to give you the financial freedom to invest in various business needs. From managing unexpected expenses to growing your operations, it's a versatile funding solution. Common uses include buying new equipment, marketing campaigns, and even hiring additional staff to support growth.

Q: Can I pay for my funding early without penalties? Yes, Teya offers flexible payment terms. Because payments are tied to your sales, you'll never be penalized for paying off your advance earlier than expected. This makes managing your cash flow simpler and stress-free.

Q: How do I set up Tap to Pay on Android with Teya? To enable it: 1. Open or download the free Teya app from Google Play Store 2. Login with your existing Teya account or Sign Up to create a new account 3. Click on "Sell" on the navigation bar at the bottom of your screen and complete the set-up steps to get started.

Q: How do I accept payments with Tap to Pay on Android? Open the Teya app on your Android phone, and click on "Sell" at the bottom of your screen. Select "Tap to Pay on Android". Enter an amount and tap "Charge". Present your Android phone to your customer. Customers can hold their card horizontally or place their payment device at the back of the phone. The transaction is processed when you hear the beep.

Q: Which Android phones are compatible? Tap to Pay on Android is compatible with the majority of Android phones. The device must be operating on Android version 12 or above and have NFC capability.

Q: Which operating systems can I use Tap to Pay on Android with? Tap to Pay on Android requires Android version 12 or above. It works best with the latest version of Android.

Q: What payment methods can I accept with Tap to Pay on Android? You can accept Visa and Mastercard payments, as well as Apple Pay and Google Pay. American Express payments are currently not supported for Tap to Pay on Android.

Q: How do I set up Tap to Pay on iPhone with Teya? To enable it: Open or download the free Teya app. Click on "Sell" on the navigation bar at the bottom of your screen. Complete the set-up steps to get started.

Q: How do I accept payments with Tap to Pay on iPhone? Open the Teya app on your iPhone, and click on "Sell" at the bottom of your screen. Select "Tap to Pay on iPhone". Enter an amount and tap "Charge". Present your iPhone to your customer. Customers can hold their card horizontally or place their payment device directly over the contactless payment icon. The transaction is processed when you see the Done checkmark.

Q: Which iPhones are compatible? Tap to Pay on iPhone requires iPhone Xs or later.

Q: Which operating systems can I use Tap to Pay on iPhone with? Tap to Pay on iPhone requires iOS 17.7.1 or later. It works best with the latest version of iOS.

Q: What payment methods can I accept with Tap to Pay on iPhone? You can accept Visa and Mastercard, as well as Apple Pay and other digital wallets, including Google Pay.

Q: How much will I be charged per transaction (Tap to Pay)? If you're already using a Teya card machine, you'll pay the same transaction fee. If you've signed up to use only Tap to Pay (on Android or iPhone) the transaction fee is 1.59%.

Q: Is there a limit to the transaction amount I can accept (Tap to Pay)? No, there is no limit to the amount you can accept. For transactions above the contactless limit on iPhone, or above £100 made with physical cards on Android, your customer will be prompted to securely enter their PIN on your phone. For transactions done with Apple Pay and Google Pay on Android, no PIN will be prompted on your phone.

Q: I have multiple stores with Teya. Will I be able to use Tap to Pay? Yes, you will be able to use Tap to Pay (Android or iPhone) for multiple stores within your company.

Q: Is Tap to Pay a secure way to accept payments? Yes, transactions are processed in accordance with the highest industry security standards. Card numbers and PINs are not stored on servers (or Apple servers for iPhone), helping to protect your business and customer data. The system prevents photo, video, screenshot, and screen-recording features from capturing a customer's card number.

Q: What are payment links and how do they work? Payment links let you accept payments without a website. From your Teya terminal, app, or portal, you can create a link and send it by email, SMS, or messaging apps. When the customer clicks the link, they're taken to our hosted checkout to complete payment.

Q: Why should I use payment links? They're perfect for remote sales—such as phone orders, deposits, invoices, or promotions—making it easy for customers to pay you securely.

Q: What type of payments can I accept via a payment link? Payment links support card payments, Apple Pay, and Google Wallet autofill.

Q: How do I create and send a payment link? Open the Teya App, Portal, or your terminal, select "Create Payment Link," enter the amount, and choose how to send it. You can send it directly by SMS or email, or copy the link to share however you like.

Q: How do I know when my customer has paid using this link? You'll see the payment instantly in the Teya App and Portal. You can also enable email notifications.

Q: Are there any extra fees for using the payment link feature? No additional service fee applies. Transaction costs are the same as other online payments, which may differ slightly from in-store rates.

Q: How quickly will I receive the money (Payment Links)? Funds from payment link transactions are settled the next business day, just like in-store payments.

Q: Are payment links secure for my customers to use? Yes. All payment links direct customers to our secure Hosted Checkout page, which protects their data and uses 3D Secure authentication.

Q: Do payment links expire? Yes. You can choose expiry times—for example, 30 minutes, 24 hours, or a custom date.

Q: When is it best to use payment links for businesses? Anytime your customer isn't in store. Many merchants use them for deposits, bookings, or follow-up payments.

Q: Can I send one link to multiple customers? Not yet. Each link is single-use, but reusable links are coming soon!

Q: How do I refund a payment that was processed through a payment link? Refunds can be managed from the Teya App, Portal, or terminal, just like your other payments.

Q: How long does it take to set up and start taking payments online? Once you have a Teya account, you can be collecting payments in minutes. Our plugins for Shopify and WooCommerce require just a few clicks and a sign-in to connect your webstore to our checkout page. You'll be ready to take live payments straight away. Settlement depends on completing onboarding, including quick identity checks.

Q: What is Hosted Checkout (or a Hosted Payment Page)? Hosted Checkout is a secure payment page provided by Teya. When a customer is ready to pay, they're redirected to this page where we securely collect their payment details, process the transaction, and then return them to your store.

Q: Why should I use Teya's Hosted Checkout instead of building my own payment form? Hosted Checkout removes the complexity of handling sensitive payment data. Teya manages the security, compliance, and authorisation steps for you, so you can focus on running your business.

Q: How does the Hosted Checkout keep my customer's payment information safe? All card data is encrypted and handled by Teya, never by your store. We're PCI DSS compliant and every payment goes through strong authentication with 3D Secure.

Q: Do I need to be PCI compliant if I use Teya's online payments? No. Because customers enter their details on our hosted checkout, Teya handles PCI compliance for you.

Q: What type of online payments can I accept? Our hosted checkout accepts Visa, Mastercard, and Amex, as well as Apple Pay and Google Wallet autofill.

Q: Can I accept international card payments from customers outside of my country? Yes. You can accept card payments from customers worldwide.

Q: Can I customise the Hosted Checkout page to match my brand? The page clearly shows your business name, giving customers confidence in who they're paying. To ensure consistency and trust, we keep the checkout design familiar and secure.

Q: Does Hosted Checkout work on mobile devices? Yes. The page is fully responsive and optimised for mobile, giving your customers a smooth experience on any device.

Q: How do I integrate the Hosted Checkout with my e-commerce platform (e.g., WooCommerce, Shopify)? Simply install our plugin from the platform's marketplace, sign in with your Teya ID, and select your store. No technical setup is required.

Q: Can the checkout process handle transactions in different currencies? Currently payments are processed in your settlement currency. Multi-currency and dynamic currency conversion are on our roadmap.

Q: What happens if a customer's payment fails on the Hosted Checkout page? The customer can try again with the same card, use another payment method, or return to your store using the back-to-store link.

Q: Does Hosted Checkout support digital wallets? Yes, Apple Pay and Google Wallet autofill are supported.

Q: Can I skip the Teya confirmation screen? Yes, you can redirect customers straight back to your store if you prefer.

Q: How secure is Teya's online payment platform for my business and customers? Every transaction through Teya's hosted checkout is fully secure. We protect cardholder data to the highest standards and authenticate each transaction with 3D Secure. Most payments are approved instantly, while a small number may require the customer to confirm in their banking app or by SMS.

Q: How do I issue a refund for an online payment? You can manage refunds directly in the Teya App or Portal. If you're using Shopify or WooCommerce, you can also process full or partial refunds from your store's admin panel.

Q: What kind of reports and insights will I get for my online transactions? All online payments appear in the Teya App and Portal, alongside your in-store sales. You'll see clear reporting on what you've sold, when, and how customers paid.

Q: When can I access the funds from my online sales? Just like with in-store payments, funds are settled the next business day into your registered account.

Q: What if I need help? We're here for you 24/7 with real people who actually help—fast, friendly, and UK-based.

Existing Teya customers: WhatsApp, email help@teya.com, or call +44 1283 896 876.

If you're not yet a customer: Contact MySvc through any of these channels—

Email: hello@mysvc.co.uk

Phone: +44 7429 529 095 or +44 7835 371 561

Ready To Simplify Your Finances & Grow Faster?

One simple account that handles payments, funding, and growth—without the nonsense of traditional banks.

© Copyright 2025 MySvc registered as Mayser Ltd - and Proud Partner of Teya - All Rights Reserved.